Earlier this week, Coinbase, the popular U.S.-based crypto exchange, added Bitcoin Cash (BCH) to its roster of currencies users can buy and sell on the site. If you’re new to cryptocurrency, Bitcoin Cash may sound like a scam. And already, claims of insider trading of Bitcoin Cash, frozen transactions, and significant volatility have plagued the currency’s December release. With all these issues, is BCH worth investing in? And how is it different than Bitcoin to begin with?

What is Bitcoin Cash?

Bitcoin Cash’s origin story is one of opportunism. As Bitcoin’s popularity grew, the transaction speed and scaling capability of the currency began to get slower and more buggy. With more users handling the coin, more people noticed these issues and demanded a solution.

Bitcoin technology is laughably slow for a currency attempting to overthrow big banks. To give an example, major credit cards process up to 1,700 transactions per second, maxing out at 24,000 per second. Bitcoin’s network can process 7 transactions per second, with each transaction averaging 10 minutes of processing time. The more people that get on Bitcoin’s blockchain, the longer transactions could take. I could watch half an episode of Atlanta and still be waiting for my bitcoins to send. I’m not a millionaire, but If I know anything about millionaires, it’s that they don’t like to wait.

In August, a group of developers and miners wanted to address these issues in addition to lowering fees. Although Bitcoin had begun creating new technology to help with scalability called Segregated Witness (SegWit2x), this group felt it was not enough, so they initiated something called a hard fork.

Instead of creating a totally new cryptocurrency, like Litecoin, IOTA, or Ripple, and starting a brand new blockchain, a fork works by just creating a duplicate version of a currency’s history. All past transactions on Bitcoin Cash’s new blockchain are identical to regular Bitcoin’s blockchain, while future transactions and balances being totally independent from each other. (For more information on how blockchain technology works, check out our explainer here.)

READ MORE:

- Everything you need to know to understand Bitcoin

- Is Bitcoin safe? How to protect your digital fortune

- How to invest in Bitcoin (without losing your shirt)

Old money, free money

An unexpected gimmick of the fork was the surprise that everyone who owned Bitcoin before Aug. 1, 2017, now had an identical amount of Bitcoin Cash recorded in its forked blockchain. A lot of people were excited by this prospect of “free money.”

But it wasn’t that easy. Originally, many providers, like Coinbase, said they wouldn’t distribute this Bitcoin Cash to users or even allow people to buy and sell it on their site. So unless people had control over their private Bitcoin keys, or held their BTC in an exchange that was crediting users with Bitcoin Cash, nobody could access these new funds. Naturally, people were upset, and by Aug. 3, 2017, Coinbase promised that it would release the cash by Jan. 1, 2018 and allow users to withdraw it. Currently, there are over 150 exchanges where you can buy, sell or trade BCH. Though I wouldn’t recommend them all, it’s important to note that Coinbase isn’t the only place you can get Bitcoin Cash.

Bitcoin vs Bitcoin Cash

Hardcore supporters of Bitcoin Cash believe that the fork was a necessary growing pain that the cryptoworld had to overcome. The legacy Bitcoin code had a maximum limit of 1MB of data per block, and it would have been relatively simple to raise this limit. But even after years of debate, the Bitcoin community could not reach a consensus on how to do that, and how much to raise it.

Bitcoin Cash succeeded in increasing its blocksize to 8MB while also accelerating the transaction verification process. In doing so, the currency hopes to get processing times down to 2 minutes and 30 seconds. The blockchain will supposedly have room for everyone’s transactions, and fees will purportedly be kept down.

But these improvements are only strong if Bitcoin Cash can maintain the high level of security that Bitcoin has always ensured. Meanwhile, Bitcoin core developers are constantly working on ways to improve transactions speeds, and it’s likely they will figure out how to fix these issues as investors continue to pour money into it.

Then there’s the fact that people have to actually use the currency. Before this month’s widespread release, the general consensus in the crypto community was that most people were just going to sell their Bitcoin Cash and invest in other currencies once the funds were available.

Insider trading?

On Tuesday, Dec. 19, when Bitcoin Cash finally hit Coinbase, after months of anticipation, things immediately got weird. The launch saw prices of BCH skyrocket to almost three times what they were listed as on other exchanges. Chaos ensued and the platform announced it would be “freezing” buying and selling of its newest asset. Then, just hours later, the company disclosed it had begun an insider trading investigation after rumors swirled on Reddit and cryptocurrency forums.

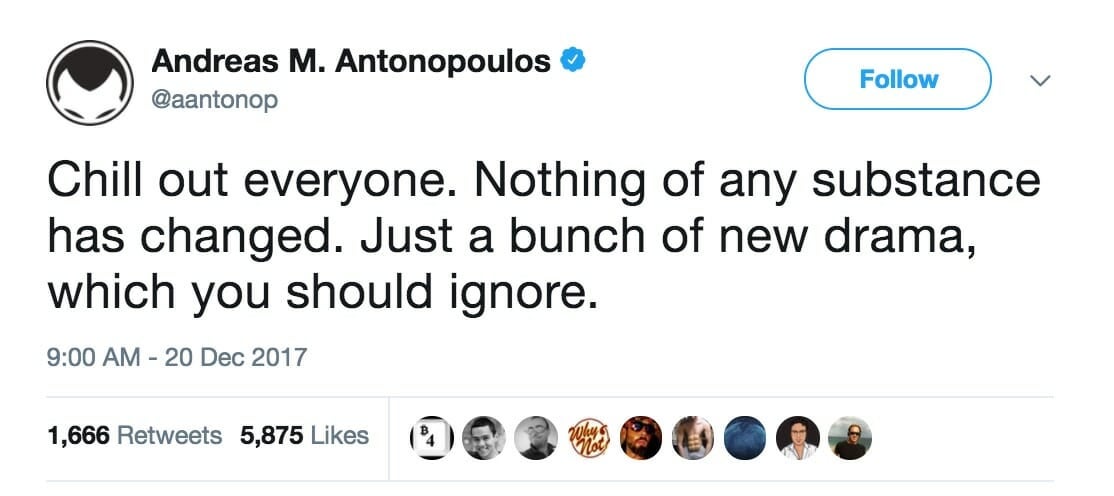

Both the BCH scandals and Bitcoin stalwarts’ “I told you so” reactions are definitely destroying the credibility of cryptocurrency. In September, the Jamie Dimon, CEO of JPMorgan Chase called Bitcoin a “fraud,” and it’s possible that most of the finance world has not come around to the idea of digital decentralization. This kind of public drama is not helping. If there’s a silver lining, it’s that the controversy may drive the price of Bitcoin Cash down.

POLL: Which side of the bitcoin civil war are you on: #Bitcoin or #BitcoinCash?

— CNBC’s Fast Money (@CNBCFastMoney) December 20, 2017

READ MORE:

- Why IOTA could be the next Bitcoin

- Why Litecoin is a smart, fast alternative to Bitcoin

- Why Ripple, the Bitcoin alternative, could be huge

So, should you invest in Bitcoin Cash?

Like all things in the cryptocurrency world, the digital finance market is a wild weird west. Wait and see how this insider trading investigation plays out, don’t keep your money on exchanges, and have faith in the technology over your capital gains. But above all, don’t be reckless.