A Florida Realtor broke down the difference between people trying to rent apartments in 1980 and 2024 and came to a startling conclusion. He contends that college graduates today are paying nearly half their wages in rent—the same predicament minimum wages workers were in 44 years ago.

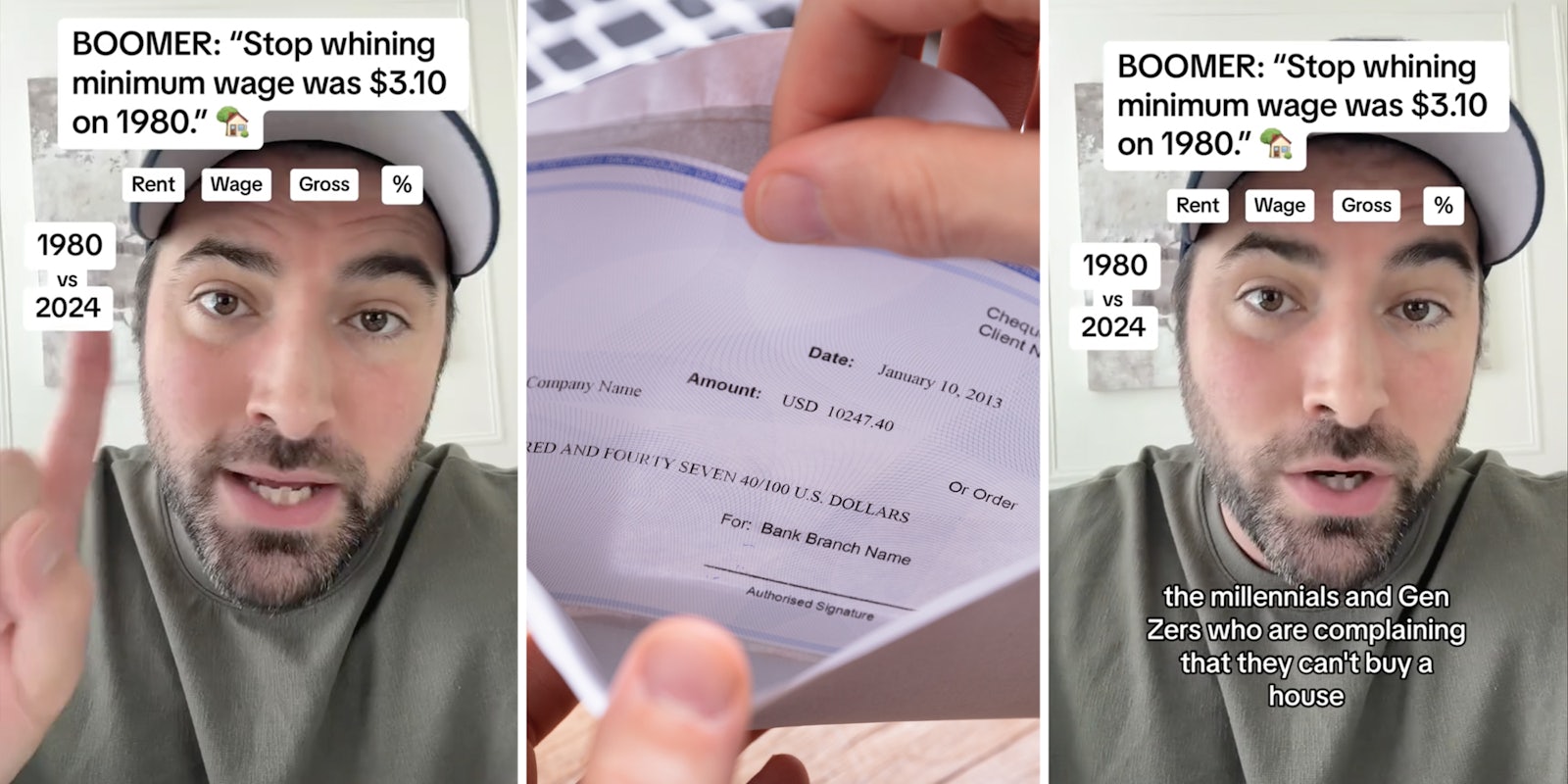

The math comes courtesy of Orlando-based Realtor and prolific TikToker Freddie Smith (@fmsmith319), who received more than 6.4 million views on the video since putting it up on Jan. 27. He starts with a caption that calls out a hypothetical boomer for saying, “Millennials and Gen Z need to stop complaining about housing prices,” before getting into his argument.

“Millennials and Gen Zers who are complaining that they can’t buy a house are not working for minimum wage,” he begins. “These are people making 60, 70, 80, $90,000 a year who can no longer afford a house. But minimum wage workers are also complaining because they can’t afford rent.”

He then brings in math. “If you look back to 1980, the rent was $243, and minimum wage was $3.10, meaning your monthly gross was $496. So, to rent this apartment, it would be 48.9% of your gross income back in 1980. But let’s fast forward to 2024. The average rent is $1,747. The federal minimum wage is $7.25, giving you $1,160. You can’t even get an apartment with a federal minimum wage.”

It is unclear where Smith got these numbers. Forbes recently cited August 2023 statistics that put the national average for rent at $1,372. However, it also did a state-by-state breakdown, with residents in California paying an average of $1,958, D.C. residents paying $1,901 on average, and New Jersey residents forking over an average of $1,850 for a place to live.

Smith then grants, “But let’s be generous and double the federal minimum wage because people at Walmart and fast food joints are making $14.50 to $15. So, $14.50 would bring you to $2,320. So technically, you’re making more, but this is your gross, and [rent would] be 75% of your gross income [if you were] making double the federal minimum wage in 2024. But let’s take it even a step further.”

@fmsmith319 Boomer: “Millennials and Gen Z need to stop complaining about housing prices.”

♬ original sound – Freddie Smith

Citing a ZipRecruiter figure that the average college graduate today makes $24 an hour, Smith charges on. “So that would be $3,840 a month,” he says. “Someone with a bachelor’s degree could afford this one-bedroom apartment, but it would be 45.4% of their gross income. A college graduate is spending the same amount of their income on rent as the minimum wage worker in 1980.”

He concludes by pointing out that while a minimum wage worker “put on a hat, learned skills for two weeks, and started their job,” a college graduate has just spent four to six years paying for college only to not be earning enough.

One commenter, invoking generational outrage and Smith’s caption, said, “Say it louder for the boomers in the back.”

Another, echoing the anxiety of other commenters, remarked, “And that’s just rent. That doesn’t account for food, kids, car insurance, car payments, and student loan payments.”

Someone else shared, “I have 2 bachelors degrees and make over 80k a year, live within my means, not a shopper or into fancy things, still can’t buy a house.”

Finally, someone confessed, “My son makes over 100k a year and still lives at home. It’s wild.”

The Daily Dot has reached out to Smith via email.