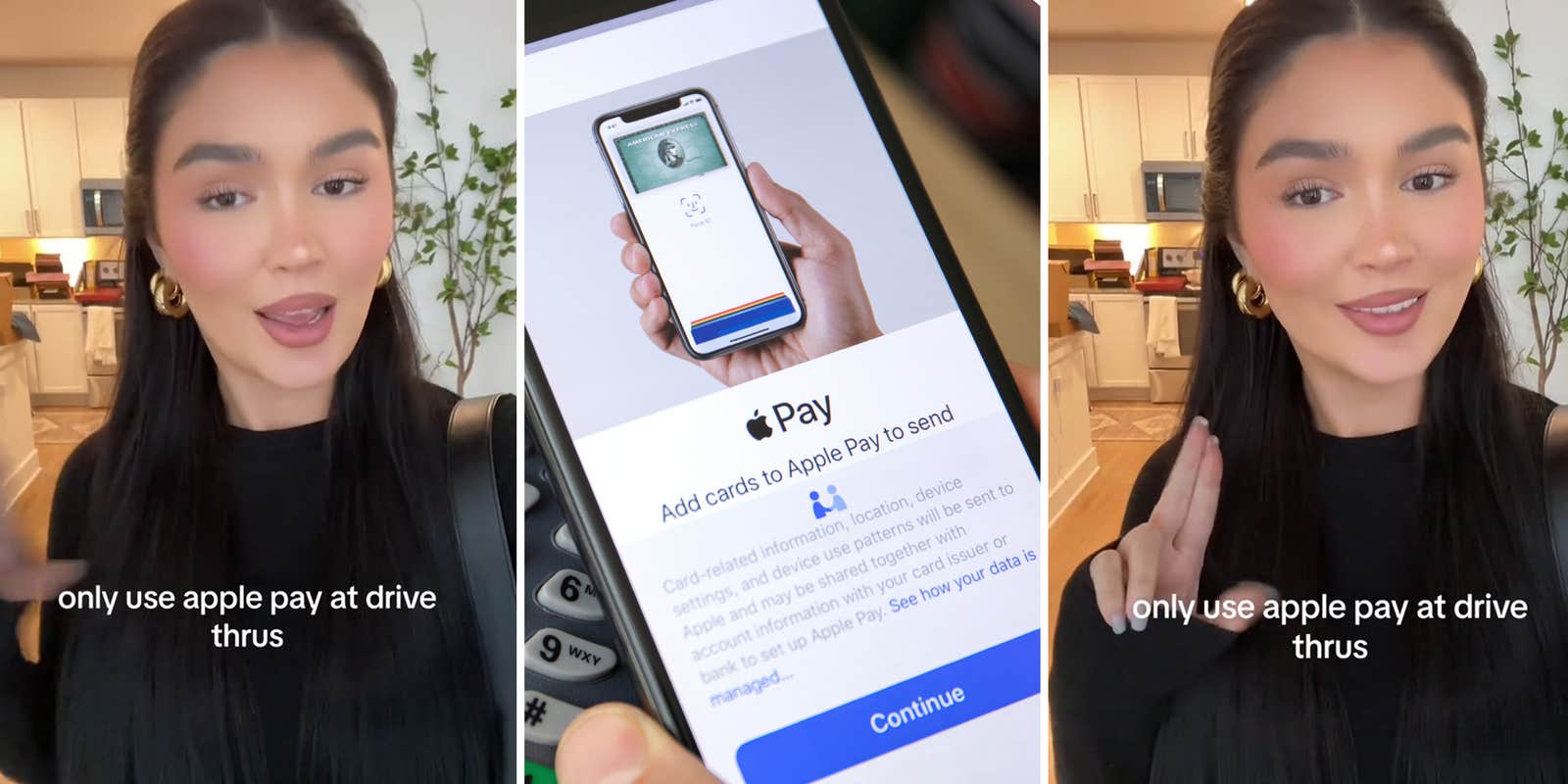

In a TikTok video titled, “People are insane,” Madi Bernard (@madibernard1) exposes a shocking case of financial fraud that unfolded at a drive-thru. It sheds light on the alarming ease with which one’s financial security can be compromised.

In the video, which has 348,000 views as of Saturday, Bernard narrates how a simple drive-thru transaction turned into a fraudulent $900 spending spree. She says it included unexpected DoorDash orders and, most startlingly, a firearm silencer. The perpetrator? Bernard says it was a shady employee who took a covert photo of her debit card during a transaction.

“So now I have a case open with the police and a detective,” she says in the clip. “So, Apple Pay, guys.”

“Only use Apple Pay at drive-thrus,” Bernard added in the video’s text overlay.

The video has sparked a wave of reactions, with the top comment urging viewers to “put alerts on your card,” highlighting a crucial defense against a fraud that is becoming all too common.

Echoing Bernard’s nightmare, another commenter shares their own experience of drive-thru fraud leading to a Walmart shopping spree, emphasizing the unpredictability and audacity of these scams.

“A silencer IS CRAZY,” they wrote. “Someone did this to me at Popeyes and they went to Walmart and had a shopping spree.”

Amidst the shock and outrage, a Canadian viewer expresses disbelief at the outdated practice of handing over cards to cashiers in the U.S., prompting a broader conversation on the need for updated payment systems in 2024.

“Ugh so sorry I’m from Canada and every time I’m in the US I’m always shocked when I have to hand my card to the server/cashier,” they said. “How is that still a system in 2024?!”

This incident isn’t merely a tale of inconvenience; it’s a stark wake-up call to the dangers of traditional payment methods in our digital era. The ease with which financial information can be compromised in such mundane settings underlines the pressing need for more secure, contactless payment options and speaks to the serious reality of financial fraud in 2024.

Apple advertises its contactless payment solution, Apple Pay, as more secure than other payment processes, writing on its website: “Apple Pay is safer than using a physical credit, debit, or prepaid card,” because, “your card number and identity aren’t shared with merchants, and your actual card numbers aren’t stored on your device or on Apple servers.

@madibernard1 people are insane

♬ original sound – madi bernard

This incident, now under police investigation, also sparked significant discourse on technology, privacy, and the importance of secure transactions. Bernard’s attempt to inject humor into the situation, hoping the fraudster’s meal was “good,” also came with a stark reminder: The importance of adopting more secure payment methods, like Apple Pay, which offers a layer of protection by not requiring users to hand over their physical cards.

Bernard’s unsettling encounter at the drive-thru serves as a poignant reminder of the fragility of our financial security in the digital age. As the community rallies around her story, sharing their own experiences and solutions, a collective call to action emerges, emphasizing the need for vigilance and the adoption of safer payment methods. This incident, far from being an isolated event, underscores a broader societal challenge: reconciling modern transactions’ convenience with the imperative of safeguarding personal and financial information.

The Daily Dot has reached out to Madi Bernard via TikTok comment for further information.

The internet is chaotic—but we’ll break it down for you in one daily email. Sign up for the Daily Dot’s web_crawlr newsletter here to get the best (and worst) of the internet straight into your inbox.