A TikToker went viral this week after claiming that, despite making payments on his student loan every month, he still owes more than the initial amount borrowed.

The first video, posted on TikTok by user Bradley (@baddie.brad), introduces his predicament, and two follow-up videos further clarify the situation. Bradley’s first TikTok about his situation has over 1.2 million views.

@baddie.brad And that’s on 7% interest

♬ original sound – You’re mine now heheheheh😩😩

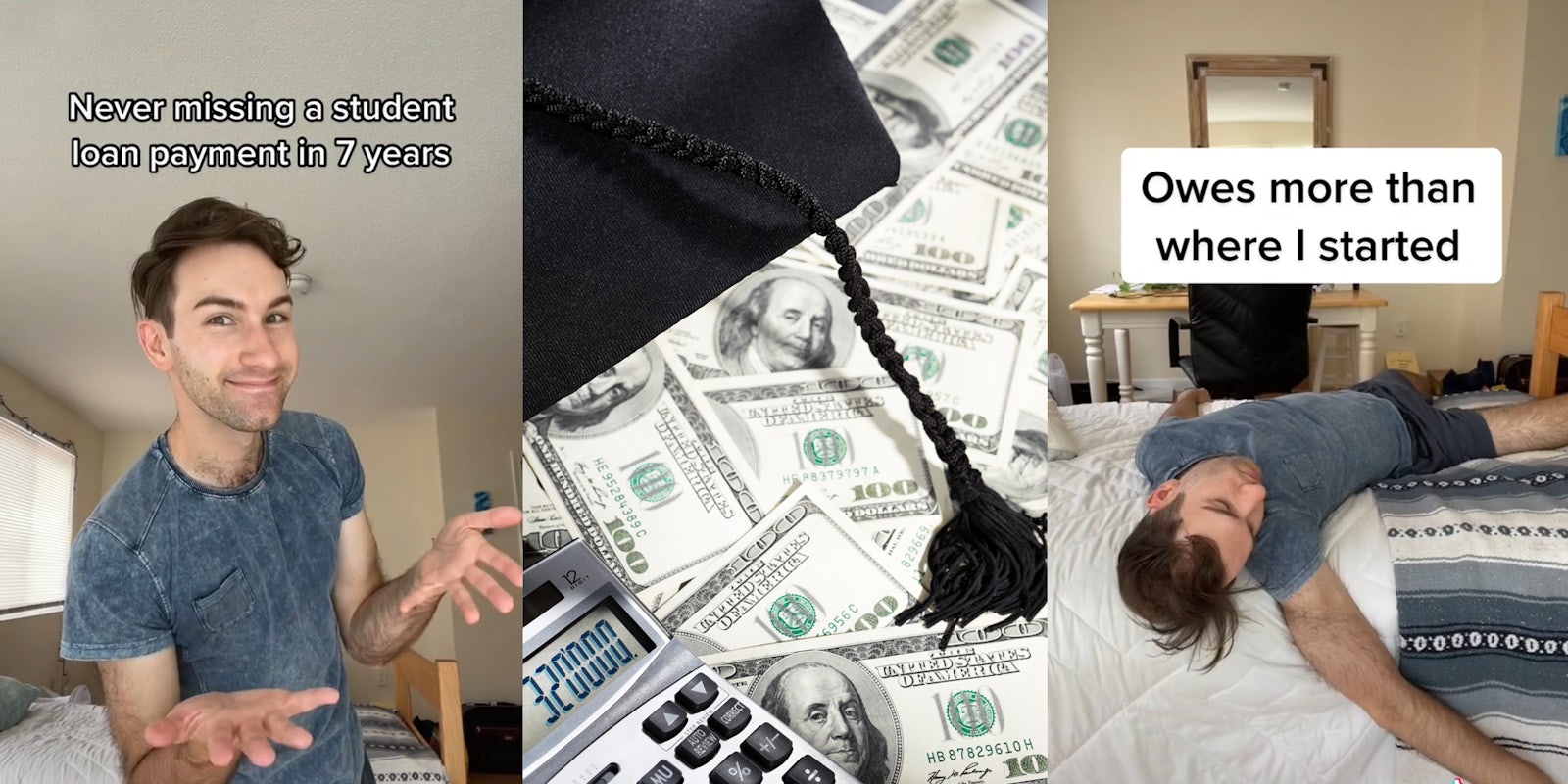

The initial video shows the TikToker making poses while a text overlaying the video reads, “Never missing a student loan payment in 7 years.”

After a few seconds, it quickly cuts to Bradley collapsed on his bed.

“Owes more than when I started,” the text now reads.

In the first follow-up video, Bradley offers more details about his situation.

“And this is the reason why I will never shut up about my student loan debt, because I want to educate people and prevent anyone from doing the dumb shit I did,” he starts the TikTok, which is in response to a comment questioning his initial video.

The creator says he graduated from college in 2013 and has put around $60,000 towards his loans since.

“But, because the interest is so high, even though I’ve paid over $60,000 toward my debt, I still now owe more than when I started,” Bradley continues.

He states that he has one loan for $114,000 with a 7% interest rate, which he pays $900 a month for. “But because the interest is so high and the amount of the loan is so high, every time it comes time to make a payment again, that $900 is essentially back from interest, and it’s moving nowhere,” he says.

In a later video, he reveals that he had a total of $130,000 in student loan debt from a degree he completed in 2013. He claims that after paying around $60,000 over the past nine years, he currently owes $147,000 total—$17,000 more than the original amount he borrowed.

@baddie.brad Reply to @vivaitalia4life ♬ original sound – Bradley

In comments, some users chastised other commenters who criticized Bradley for apparently not understanding the terms of his student loan debt.

“The comments didn’t pass the vibe check. Some of you are forgetting we sign up for loans when we’re still kids… literally 17&18 years old,” one user wrote. “The whole ‘just pay more per month’ thing, are you forgetting some people can’t??? I went to the same school he did it’s not his fault at all they are such a scam when it comes to financials there.”

“Instead of blaming him for taking out a loan why are you all not blaming the ridiculous system of student [loans?],” the same user concluded.

Others simply sympathized with Bradley.

“College debt [has] been one of my biggest regrets in life,” one commenter shared.

“I make the smallest payment I can and figure I’ll die with it,” another offered.

The latter is a common thought amongst those with student loan debt. In 2021, Investopedia reported that “nearly one-third of all American students now have to go into debt to get through college, and the average student loan debt reached a record high of $40,904 in 2021. Collectively, they owe about $1.75 trillion.”

Furthermore, “1 in 5 millennials with debt expect to die without ever paying it off,” NBC reported in 2019.

Bradley’s issue stems from the fact that, when he makes payments, the money is seemingly being applied to the interest, not the principal loan. That means that every time he pays, the money goes solely to the additional debt accrued by interest, not the base amount. Because of this, he can expect to continue paying this indefinitely unless he can pay more to offset the principal.

His issue persists even after the federal government issued a pause on student loan interest rates and required monthly loan payments in March 2020 due to the COVID-19 pandemic. While interest rates for most student loans have been at 0% for over two years, the pause is set to end August 31. Though this measure may have given many with immense student debt a chance to chip away at the debt accrued by interest, it’s unclear what kind of loans Bradley took out and whether or not the pause applied to them.

Commenters on TikTok offered their own solutions, such as making education free or low cost (something already done by many nations around the world, per Top Universities), lowering or removing interest rates, or, as proposed by some activists, canceling student debt entirely.

Regardless of how the problem is solved, users on TikTok are fed up with the current system.

As one user wrote, “Our system is so broken!”

We’ve reached out to Bradley via TikTok comment.

Today’s top stories

| ‘Fill her up’: Bartender gives woman a glass of water when the man she’s with orders tequila shot |

| ‘I don’t think my store has even sold one’: Whataburger employees take picture with first customer who bought a burger box |

| ‘It was a template used by anyone in the company’: Travel agent’s ‘condescending’ out-of-office email reply sparks debate |

| Sign up to receive the Daily Dot’s Internet Insider newsletter for urgent news from the frontline of online. |