In the United States, 1.1 million workers earn wages at or below the federal minimum of $7.25 an hour, per the U.S. Bureau of Labor Statistics, and “nearly 52 million U.S. workers—or 32% of the country’s workforce—earn less than $15 an hour,” per Bloomberg.

Alongside this prevalence of low-wage work comes rising inflation, which remained “near a 40-year high in August.”

Now, a user on TikTok has gone viral after claiming that, factoring in taxes and the nationwide average costs for various aspects of life like rent and gasoline, anyone making under $25 is currently or should expect to live paycheck-to-paycheck.

“If you’re making less than $25 an hour right now, you should be terrified,” user Ryan (@digitalsolutionss) says at the beginning of his TikTok.

The video currently has over 1.3 million views.

@digitalsolutionss if you aren’t struggling from this yet, you will. don’t wait until that happens. take action now

♬ original sound – Ryan Halbert | Business Growth

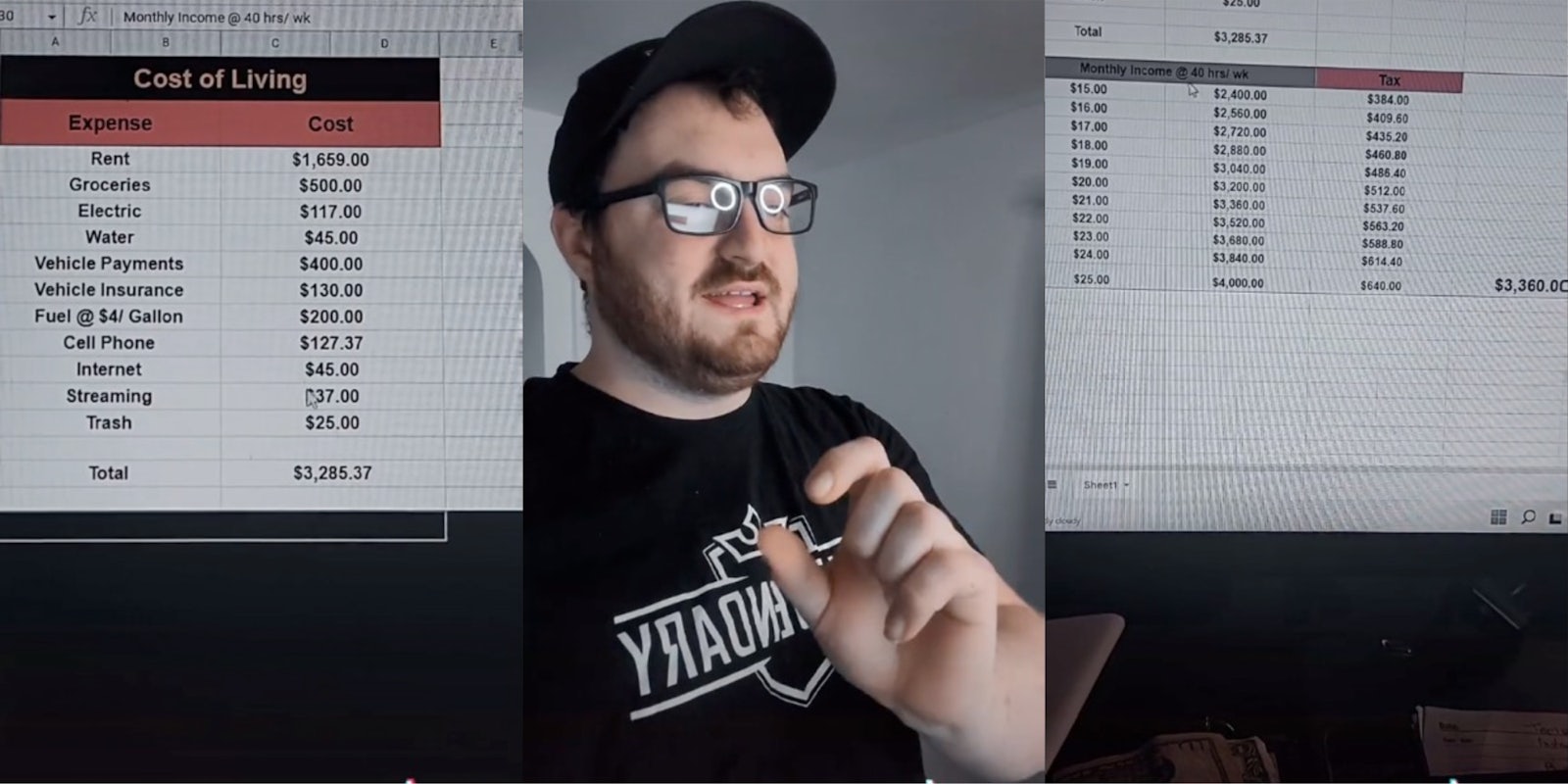

In the video, Ryan breaks down average costs, ranging from $1,659 for monthly rent (slightly below the median nationwide rent price of $2000), $500 for groceries, $127.37 for a cell phone plan, and smaller added costs for streaming services, among others.

After adding up all of these costs, Ryan comes to a total of $3,287.37 for the average American’s monthly living costs. Using this number, he compares the amount earned from a 40-hour work week at various wages to the weekly amount needed to meet this amount after taxes. The first hourly wage to cross the ‘breaking-even’ threshold is $25 an hour.

“Keep in mind, these expenses are factoring in doing nothing. No free time, no going out to eat, no extra miles on the car, nothing,” he says. “You didn’t have a breakdown that month, you incurred no additional hardships. This is just your cost of living and what you have to make in order to cover it.”

Furthermore, Ryan stresses that cutting out things like streaming services only saves a small amount in terms of yearly expenditure.

In comments, many pointed out that people could simply live with roommates or a parent if they needed to save money on rent. However, needing to pair or triple up in order to survive is a relatively new phenomenon.

“In 1975, only 11% of adults 18 to 34 lived with roommates,” explains Hannah Metzger for Colorado Newsline. In 2015, that number reached 25.2%.

Commenters on TikTok agreed that the number of hours and wages needed to survive in America today was simply too much.

“I make more money than I ever have in my life and I still can’t do more than barely scrape by,” wrote one user.

“I usually work close to 70 hours a week and I’m having a hard time. Health fell apart after 6 months of that,” claimed another.

“My husband works 50-70 hours a week just to support us. I quit my job in May bc childcare costs are RIDICULOUS,” added a third.

The Daily Dot reached out to Ryan via Instagram direct message.

Update 6:49am CT June 1: In an Instagram DM exchange with the Daily Dot, Ryan, who runs a site about starting online businesses, offered his thoughts on the importance of wages in the current working environment.

“I do have a strong opinion about the importance of employees, both entry level and highly skilled, having the confidence and skills to negotiate a fair wage and benefits,” he shared. “This is something that should be done both when interviewing for the positions and during regular work related evaluations.”

“Too often, an employee will settle for a wage because ‘this is what this position is paying’ when in reality there is almost always room for an individual to say, ‘this is how I will be able to perform and this is what I can bring to the table; due to this, I am not your average walk in from the street, and I would require my salary to be in [insert a reasonable, desired range of pay],’” he continued.

“Knowing that, most individuals, when applying for a position they are a good fit for, will have some level of leverage that they can use to their advantage when negotiating pay and benefits,” he shared. “This falls under the expression of ‘know your worth,’ which I believe is taken less literally than than it should be during negotiations in the job market. A career is something that will use a very large portion of your life and is what will determine on many levels the quality of your life, so the negotiations that take place before and during employment shouldn’t be taken lightly.”

“This point of view is inspired by my mother, who is a medical professional,” he revealed. “She a very hard working and highly educated individual and has had her fair share of being under-compensated in the workplace — but has always been able to improve her situation through negotiations, whether that meant keeping a position or moving into another.”