President Donald Trump and Republicans unveiled their tax reform plan to overhaul the United States tax code, a proposal they hope will become their first major legislative victory since taking power after last year’s election.

The new tax reform framework is vague in certain areas, leaving some decisions up to Congress. As written, the plan would cut the tax rate for wealthy Americans and drop taxes for businesses.

“With significant and meaningful tax reform and relief, we will create a fairer system that levels the playing field and extends economic opportunities to American workers, small businesses, and middle-income families,” the plan reads.

The tax reform plan would collapse individual tax brackets from seven to three–or 12 percent, 25 percent and 35 percent. The current highest tax rate is 39.6 percent and the lowest is 10 percent. The plan also allows Congress to consider adding a fourth bracket above 35 percent, according to the New York Times.

It will be up to Congress to assign the income ranges that would be under each bracket.

The standard deduction for individuals would double to $12,000 and to $24,000 for married couples. The plan would also eliminate the estate tax, a tax on inherited wealth.

As for companies, the proposal would slash the corporate tax rate from 35 percent to 20 percent.

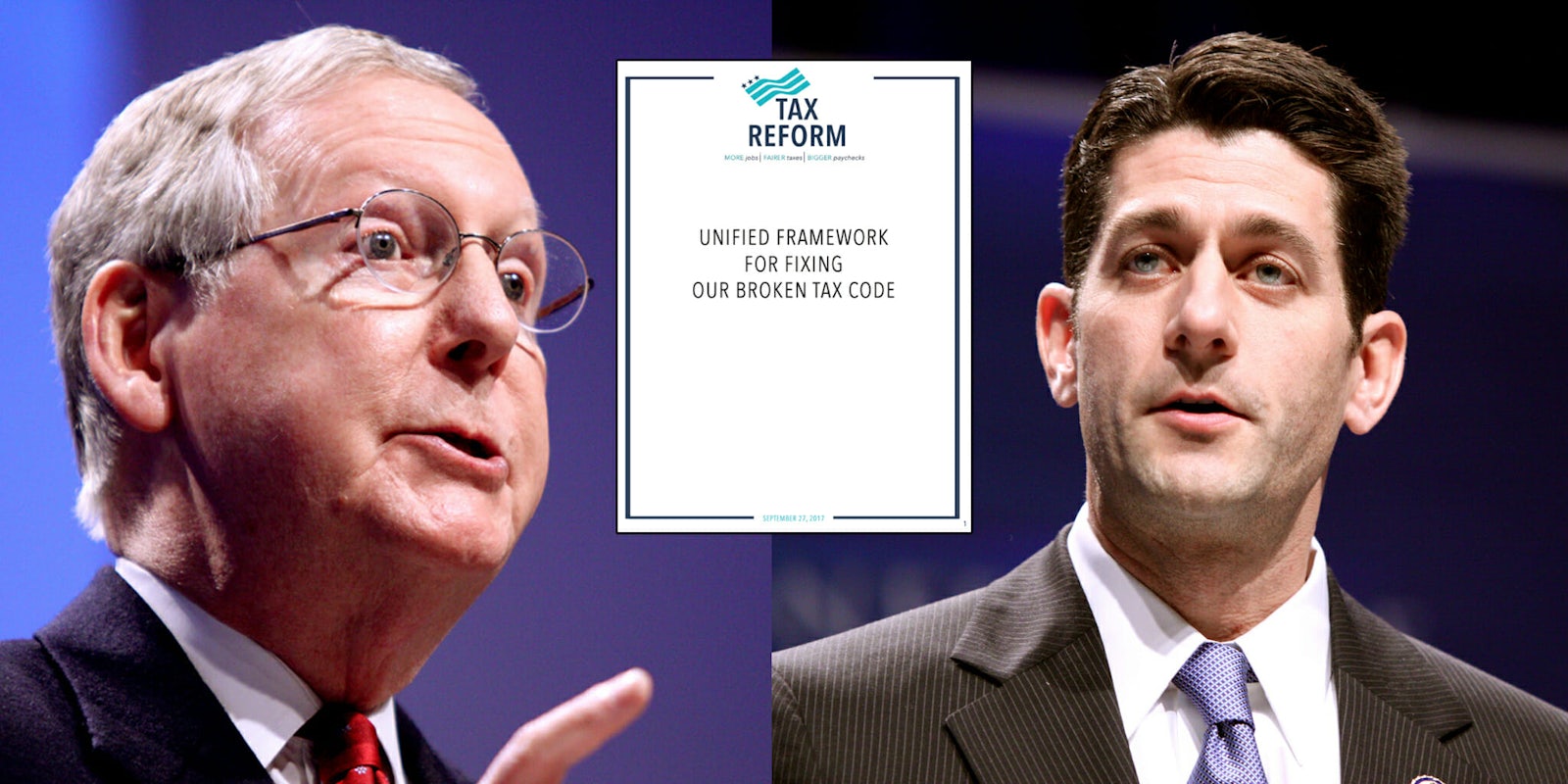

The tax plan was created by the so-called “Big Six:” Treasury Secretary Steve Mnuchin, National Economic Council director Gary Cohn, House Speaker Paul Ryan (R-Wisc.), Ways and Means Committee Chair Kevin Brady (R-Texas), Senate Majority Leader Mitch McConnell and Finance Committee Chair Orrin Hatch (R-Utah). Trump is expected to speak about the plan on Wednesday afternoon.

The blueprint also calls for legislators to retain tax incentives for homeownership, retirement savings, charitable giving and higher education.

You can read the entire plan here.