Owning a home is becoming more of a distant dream for many Americans as years progress, with younger generations feeling a sense of hopelessness in even attempting to buy a home in an area they’d want to live in.

It’s this reality that has one TikToker who goes by Average Joe (@averagejoegam3) stating it’s no wonder so many citizens are “quiet quitting” their jobs in a TikTok that was viewed over 9.9 million times.

In his video, Joe said that although he and his wife are no longer living paycheck to paycheck, which 60% of Americans reportedly do as of 2023, and earn a combined annual income of $120,000, he is unable to find a home in his area within their price range that is habitable.

@averagejoegam3 This has to change. #quietquitting #inflation #truth #millennial #genz #boomer #genx #debate #housingmarket #greenscreen ♬ original sound – Average Joe

Joe started his video by saying he’s going to “show” viewers “exactly why the younger generations are quiet quitting,” which is when a worker does the bare minimum at their job.

Joe said both he and his wife have been searching for a home and shared the struggles they’ve encountered while doing so. “My wife and I have been together for seven years. In those seven years we came up the old fashioned way. We have two kids. We really struggled for a long time, and we just got up to seven years of struggling and sacrificing got to a point where we’re no longer paycheck to paycheck. She finished school, I worked my way up at my job,” he said.

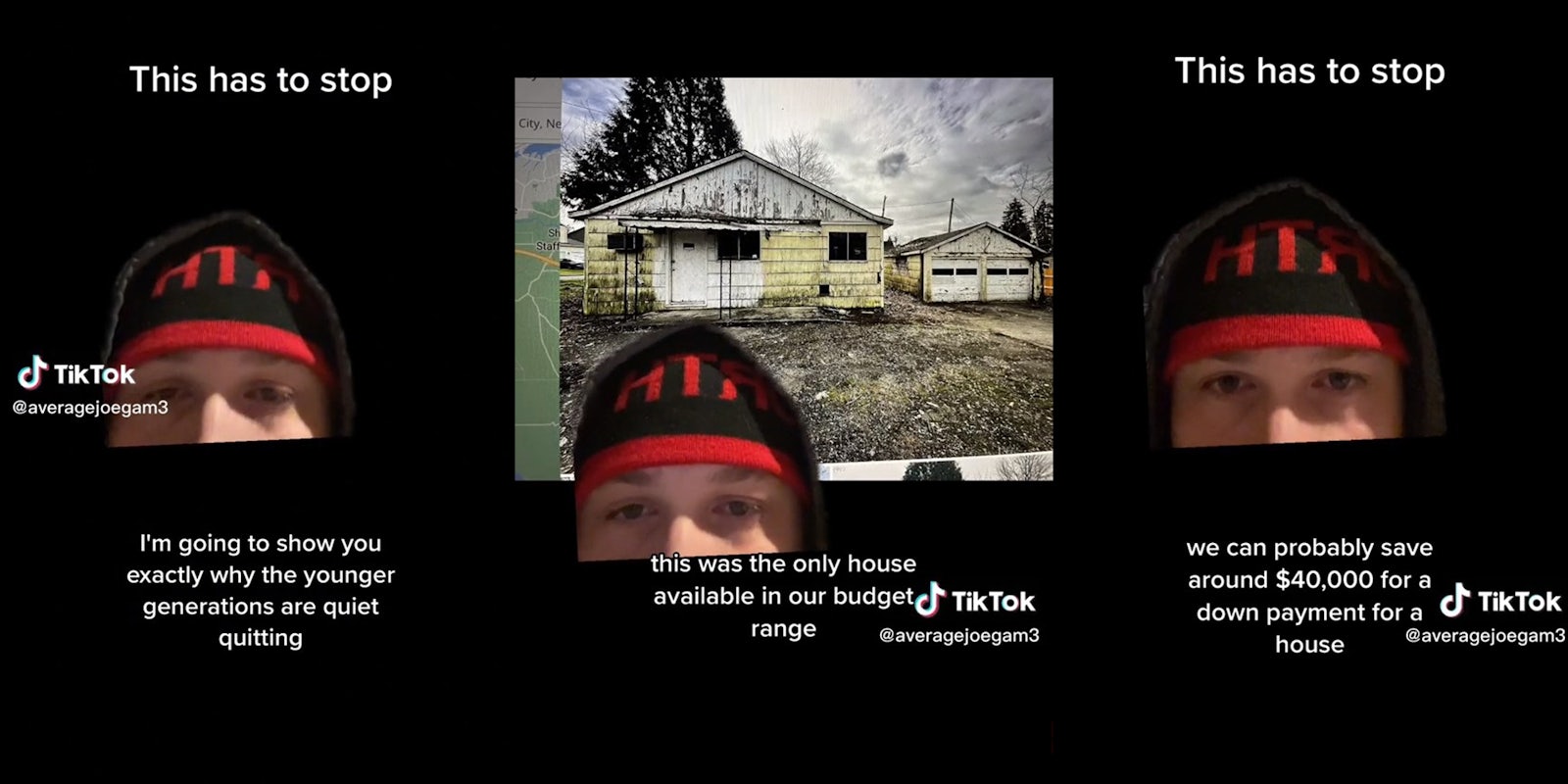

Joe said they were able to save $40,000 for a down payment on a home, but even with their comfortable monetary situation and hefty down payment, their choices in housing are slim for their area. “We make $120,000 a year combined household income, and in two years, we financed and budgeted things out. … After seven years of struggling, working our asses off, and building ourselves up into this country to buy a house, let me show you what $120,000 a year, with good credit, gets you,” he said.

The clip then transitioned to a dilapidated-looking home with cracked paint on the exterior. “This was the only house available in our budget range in our location where we live. There was one house for sale, and it was this one right here. This is what we can afford with $120,000 combined income and a $40,000 down payment with good credit. Our cars are paid off, we sacrificed, we worked hard. … This is what we can get,” he said.

Joe then challenged people in older generations who tout the notion that “no one wants to work anymore.”

“Everybody that is in the older generation saying, ‘Well I guess you better go to college’ or ‘Guess you better go get a degree find a trade something that makes you more valuable to the community.’ Was it always like that? Is that how it always was? Did you have to be a doctor, a lawyer, an architect, an engineer, to get a livable house with a very substantial income?” he questioned, arguing that his mom worked at Michaels and his dad was a pressman in a printing company. “They both bought a house that is nowadays probably $600,000 at the age of 23.”

While Joe doesn’t list the area where he found the home, there are statistics that support his claim of how difficult it is for even financially well-off Americans to afford their own home. It was reportedly easier for Americans to purchase a home during the Great Depression than it is for U.S. citizens to be able to afford a house today.

Viewers supported Joe’s sentiments and echoed how times have changed in the comments section. “A 100K salary is the new 50K salary,” one of the top comments reads.

“It’s not that nobody wants to work anymore, nobody wants to be exploited,” TikToker @kassycakes said.

“Anyone working full time should be able to afford a modest home, car, clothes & food…at the least. It’s gone too far,” a third argued.

The Daily Dot has reached out to Joe via TikTok comment for further information.